The Crisis is Over, but its Scarring Effects are Hindering Recovery

Vasily Astrov, Alexandra Bykova, Rumen Dobrinsky, Selena Duraković, Meryem Gökten, Richard Grieveson, Doris Hanzl-Weiss, Marcus How, Gabor Hunya, Branimir Jovanović, Niko Korpar, Sebastian Leitner, Isilda Mara, Olga Pindyuk, Sandor Richter, Marko Sošić, Bernd Christoph Ströhm, Maryna Tverdostup, Zuzana Zavarská and Adam Żurawski

wiiw Forecast Report No. Spring 2024, April 2024

156 pages including 29 Tables and 50 Figures

The current report is only available to members. Past issues become freely available online when the next report is released. Several individual sections of the report are freely available to download now (see below).

Executive summary

by Olga Pindyuk

free download

Indicators 2022-2023 and Outlook 2024-2026

Premium Members only

Summary of key recent macroeconomic data for CESEE, and overview of new wiiw forecasts for 2024-2026 (Excel file)

1. Global assumptions: US driving recovery amid geopolitical risks

by Richard Grieveson

The global economy is strengthening, with the US remaining strong, and better data out of China in recent months. Encouragingly, the euro area economy is also starting to show some signs of recovery, with inflation falling more quickly than we previously expected, boosting real incomes, but the recovery in the manufacturing sector is yet to arrive. The biggest risk to the recovery at present comes from geopolitics, specifically in the US, where the outcome of the next presidential election will be crucial, and in the Middle East, where heightened tensions involving a number of regional players risk causing a significant and prolonged rise in energy prices. If that happens, it will push global inflation back up, weighing on consumption, and will also delay monetary loosening by the major central banks.

2. CESEE Overview: The crisis is over, but its scarring effects are hindering recovery

by Olga Pindyuk

In the next three years, annual GDP growth in CESEE will be about 3%; that will allow economic convergence with the euro area, but at a relatively slow speed. Growth will be driven mainly by household consumption supported by rising real wages amid decelerating inflation. Investment will be constrained by limited access to financing and will be insufficiently high to promote a faster green and digital transition and to ensure the structural changes needed to boost the region’s competitiveness. Risks to the outlook remain mostly on the downside, with the most significant of these related to geopolitics.

3. Austria and CESEE: Regional growth to continue to provide an important stimulus for Austria

by Doris Hanzl-Weiss

Growth in CESEE will be higher than in the euro area during the forecast period, providing impetus for the Austrian economy. The potential expiration of the gas transit agreement between Gazprom and Ukraine at the end of 2024 presents a challenge for countries along the gas route from Ukraine, through Slovakia to Austria. Neighbouring CESEE countries are again a primary focus for Austrian investors, with Croatia and Hungary the main targets. Austrian companies are largely maintaining their presence and activity in Russia.

4. Wavering consensus? The impact of the 2024 bumper election year on Ukraine and European security

by Marcus How

The Russian invasion of Ukraine continues to be the main driver of political risks in CESEE. These risks are currently elevated, due to the elections to the European Parliament, the US presidency and Congress, as well as to the parliaments of states in the region. The European elections are likely to result in a rightward tilt at the EU level, fraying the consensus surrounding those European Commission flagship policies that are pertinent to strategic autonomy. The ‘Mitteleuropean’ axis of populist illiberalism may begin to consolidate, with the Austrian elections being of particular importance. This would complicate EU efforts to agree new aid for Ukraine – efforts that are especially significant given the political instability in the US. If Donald Trump is elected president in November, the US commitment not only to Ukraine but also to NATO will very likely end, increasing the security risks. The EU and European NATO members would be able to compensate for some (but not all) of the US commitments – if it can muster the political will. However, this political will may diminish, given the influence of the aforementioned internal and external factors.

free download

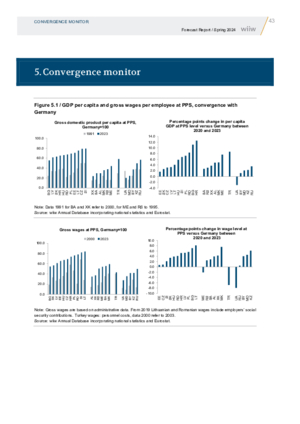

5. Convergence Monitor

by wiiw statistics department

Economic growth will strengthen in most countries of CESEE in 2024, as falling inflation boosts real incomes and consumer spending. The outlook for investment is more mixed, while the external sector in CESEE is still waiting for a recovery in German industry. Although the medium-term outlook is reasonably positive, CESEE faces significant downside risks to growth, including a potential victory for Donald Trump in the next US election, higher energy prices due to tensions in the Middle East, a delayed German recovery, and financial instability caused by high real interest rates.

Reference to wiiw databases: wiiw Annual Database, wiiw Monthly Database

Keywords: CESEE Central and Eastern Europe, economic forecast, Western Balkans, CIS, Ukraine, Russia, Turkey, EU, business cycle, economic sentiment, euro area, convergence, labour markets, unemployment, Russia-Ukraine war, commodity prices, inflation, price controls, trade disruptions, renewable energy, gas, electricity, monetary policy, fiscal policy, impact on Austria

JEL classification: E20, E21, E22, E24, E27, E31, E32, E5, E62, F21, F31, F51, H56, H60, J20, J30, O47, O52, O57, Q42

Countries covered: Albania, Austria, Belarus, Bosnia and Herzegovina, Bulgaria, Central and East Europe, CESEE, CIS, Croatia, Czechia, Estonia, Euro Area, European Union, Hungary, Kazakhstan, Kosovo, Latvia, Lithuania, Moldova, Montenegro, North Macedonia, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Southeast Europe, Turkey, Ukraine, US, Western Balkans

Research Areas: Macroeconomic Analysis and Policy, International Trade, Competitiveness and FDI

ISBN-13: 978-3-85209-079-5